A partner of major global financial institutions, LM Capital is an Independent Financial Company, recognized for its leading Wealth Management capabilities, offering first-class services in Private Wealth Management and Multi Family Office services.

We are LM Capital: an independent Family Business specializing in Private Wealth Management and Multi Family Office services. We are based in Montreux and Martigny in the heart of French-speaking Switzerland.

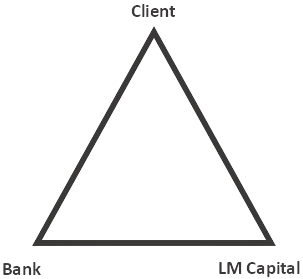

At LM Capital, our main concern is to serve the best interests of our clients. We make a point of providing personalized financial advice and applying our own dynamic management approach. Our solid experience has enabled us to establish lasting partnerships with renowned banking institutions and specialist service providers in various fields.

As a Wealth Manager authorized by FINMA and supervised by a supervisory body, we attach great importance to regulatory compliance. It is an integral part of all our day-to-day activities.

LM Capital is your privileged partner in Private Wealth Management and Multi Family Office. We are here to help you achieve your financial goals and offert you tailor-made expertise.

At LM Capital, we are committed to providing the very best in Wealth Management and family office services. Thanks to our in-depth expertise and personalized approach, we offer solutions tailored to your specific needs. As your Wealth Manager, we aim to optimize the management of your financial and property assets, taking into account your objectives, risk tolerance and overall financial situation.

Our professionals monitor market trends on a daily basis to provide you with sound advice and personalized recommendations. We also understand the importance of coordinating and managing your overall wealth, including estate planning, property management, philanthropy and Trust services.

Wealth Management is our core expertise. Thanks to our expert, multidisciplinary approach, you can access to top-quality investments that will help develop your assets.

In order to diversify your investments, we specialize in alternative solutions that offer additional long-term returns unmatched by traditional markets.

In addition to our portfolio management expertise, we also offer specialized asset management services focused on certificate-based products. These products optimize our clients’ investment strategy with flexibility and diversification while ensuring personalized management.

In partnership with our network of banks and insurance providers, we offer customized financing and long-term support for your real estate projects. Additionally, we assist you in transactions with our expertise and network to help you achieve your goals efficiently.

Find out more about our complementary services in Family Office, Real Estate consulting and financial planning for your Wealth Management.

Our 4 fundamental quality principles form the foundation of our commitment to our clients. By respecting these, we strive to exceed your expectations and offer you an unparalleled experience. Your satisfaction is our top priority, and we work tirelessly to maintain high standards of quality in every aspect of our collaboration.

01

Independence is the cornerstone of our approach. We pride ourselves on being an independent entity, free from any conflict of interest, which enables us to make informed and impartial decisions are based exclusively on objective and rigorous assessment, free from any outside influence.

02

Availability is a value that we emphasize to meet our clients’ needs efficiently. We understand the importance of providing fast answers and tailored solutions in a constantly changing world. Our dedicated team is always ready to accompany you and answer your questions.

03

Transparency is at the heart of our relationship with our clients. We believe in open and honest communication, keeping you informed at every stage. We share all relevant information with you, whether it is our methodologies, the results of our analyses or the costs associated with our services. This transparency fosters mutual trust and enables you to make informed decisions.

04

Customization is our promise to provide you with made-to-measure solutions. We recognize that every customer is unique, with their own needs, objectives and constraints. We are committed to understanding your specific and tailoring our services to best meet your expectations. We invest time and resources to develop customized solutions that maximize your added value and promote your success.

At LM Capital, we have fully digitalized our entire ecosystem. Every client of our company benefits from complete access to our digital platforms, enhancing their customer experience and management tracking. We have also invested in a skilled team to meet the needs of younger clients, providing them with a personalized and high-quality service.

Furthermore, our PMS (Portfolio Management System) enables the consolidation of multi-bank and multi-generational portfolios. This feature is highly valued by our clients, as it provides them with a clear and precise overview of their overall wealth evolution, regardless of the data source. With this advanced technology, we ensure rigorous monitoring and complete transparency, facilitating financial and wealth management decision-making.

Since January 2021, LM Capital has had a long-term strategic development partner for its Data Science solutions. The aim of this partnership is to train students in HEC Lausanne’s Master of Management in Business Analytics by confronting them with real-life problems in the field of finance. These projects, most of which have already been completed, have become fully-fledged analysis and management programs at LM Capital.

In addition to wealth management, our team of investment advisors specializes in a variety of areas, including private equity and real estate. We understand the importance of developing personalized investment strategies to maximize your returns and manage your wealth effectively.